Travel Insurance Things To Know Before You Get This

Wiki Article

About Health Insurance

Table of ContentsThe Single Strategy To Use For MedicaidAll About Home InsuranceHealth Insurance Things To Know Before You Get ThisThe Only Guide for Health Insurance

You Might Want Handicap Insurance Policy Too "In contrast to what lots of people assume, their residence or auto is not their greatest asset. Rather, it is their capability to make an income. Many experts do not insure the possibility of a handicap," stated John Barnes, CFP and owner of My Household Life Insurance Policy, in an e-mail to The Balance.

The information listed below concentrates on life insurance policy sold to people. Term Term Insurance policy is the simplest type of life insurance coverage. It pays just if death occurs throughout the regard to the policy, which is normally from one to three decades. A lot of term plans have no other benefit stipulations. There are two standard sorts of term life insurance policy plans: degree term and reducing term.

The cost per $1,000 of benefit increases as the insured individual ages, and also it obviously obtains really high when the guaranteed lives to 80 as well as past. The insurance policy company might charge a premium that raises each year, however that would certainly make it extremely hard for lots of people to manage life insurance policy at innovative ages.

Renters Insurance Fundamentals Explained

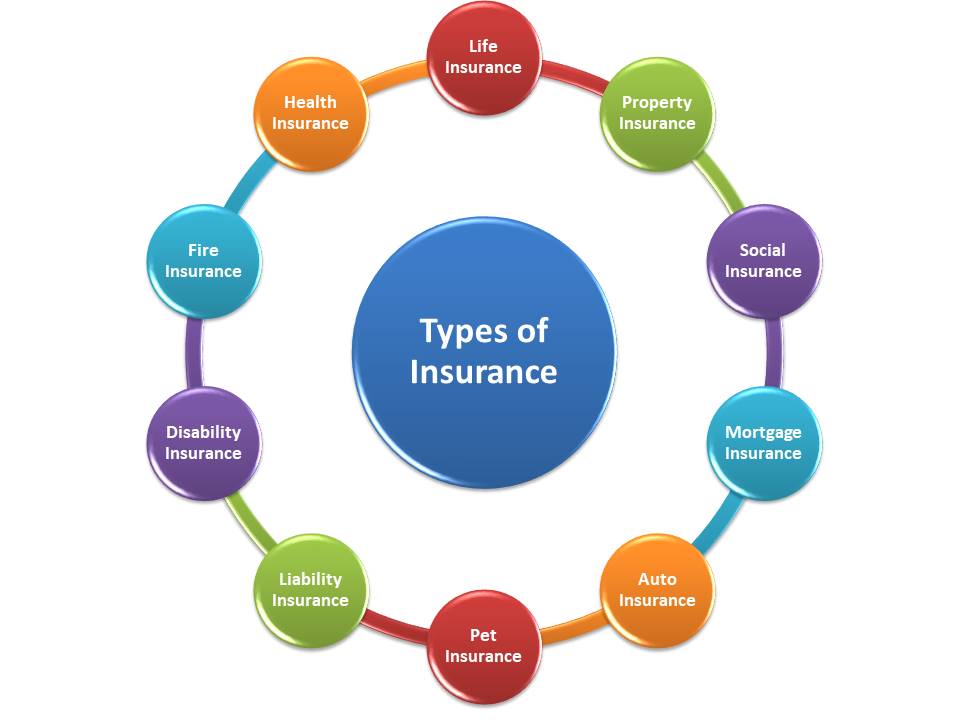

Insurance policy plans are developed on the principle that although we can not quit regrettable events occurring, we can shield ourselves monetarily versus them. There are a huge number of various insurance plan readily available on the marketplace, as well as all insurance firms attempt to convince us of the values of their specific item. So a lot to make sure that it can be tough to make a decision which insurance coverage are truly essential, as well as which ones we can realistically live without.Researchers have found that if the key breadwinner were to die their family would just be able to cover their house expenses for simply a couple of months; one in 4 family members would have issues covering their outgoings immediately. The majority of insurance firms suggest that you obtain cover for around ten times your annual earnings - renters insurance.

You ought to additionally factor in childcare expenses, as well as future college fees if suitable. There are two main kinds of life insurance coverage policy to select from: entire life plans, and term life policies. You pay for entire life plans till you die, as well as you pay for term life policies for a collection amount of time established when you get the policy.

Medical Insurance, Medical Insurance is another one of the 4 main sorts of insurance that experts advise. A current study exposed that sixty two percent of personal insolvencies in the United States in 2007 were as a straight result of wellness issues. A surprising seventy eight percent of these filers had medical insurance when their health problem started.

Our Cheap Car Insurance Statements

Premiums differ substantially according to your age, your present state of wellness, and your lifestyle. Auto Insurance coverage, Rule range various nations, but the significance of car insurance coverage remains consistent. Even if it is not a lawful demand to take out car insurance policy where you live professional indemnity insurance it is extremely recommended that you have some kind of policy in position as you will still need to assume monetary obligation when it comes to an accident.Furthermore, your vehicle is usually among your most valuable assets, as well as if it is damaged in an accident you may battle to spend for repair work, or for a replacement. You could likewise discover on your own accountable for injuries suffered by your travelers, or the motorist of an additional automobile, and also for damages triggered to another lorry as an outcome of your carelessness.

General insurance coverage covers house, your travel, vehicle, and health (non-life properties) from fire, floods, crashes, man-made calamities, and also theft. Different kinds of basic insurance coverage include electric motor insurance coverage, medical insurance, traveling insurance coverage, as well as house insurance. A general insurance coverage spends for the losses that are incurred by the guaranteed during the duration of the plan.

Read on to recognize even more regarding them: As the house is an useful belongings, it is necessary to safeguard your home with a proper. Residence and also family insurance policy protect your useful site house and the things in it. A home insurance coverage essentially covers man-made as well as all-natural scenarios that may lead to damages or loss.

The Only Guide to Health Insurance

It comes in 2 kinds, third-party and also extensive. When your car is in charge of a mishap, third-party insurance policy looks after the harm caused to a third-party. Nevertheless, you must think about one fact that it does not cover any of your vehicle's damages. It is also vital to keep in mind that third-party motor insurance coverage is necessary according to the Motor Autos Act, 1988.

A hospitalization expenditures up to the sum insured. When it pertains to health and wellness insurance coverage, one can select a standalone health plan or a family members floater plan that provides coverage for all member of the family. Life insurance policy gives protection for your life. If a scenario takes place in which the policyholder has a sudden death within the regard to the policy, then the candidate obtains the sum ensured by the insurance coverage firm.

Life insurance is different from basic insurance policy on various parameters: is a temporary agreement whereas life insurance is a lasting contract. In the case of life insurance policy, the benefits and also the amount assured is paid on the maturity of the policy or in the occasion of the policy owner's death.

They are nevertheless not compulsory to have. The general insurance policy cover that is required is third-party liability automobile insurance coverage. This is the minimum protection that a car must have before they can layer on Indian roadways. Each and also every type of basic insurance coverage cover features a purpose, to a fantastic read supply coverage for a particular facet.

Report this wiki page